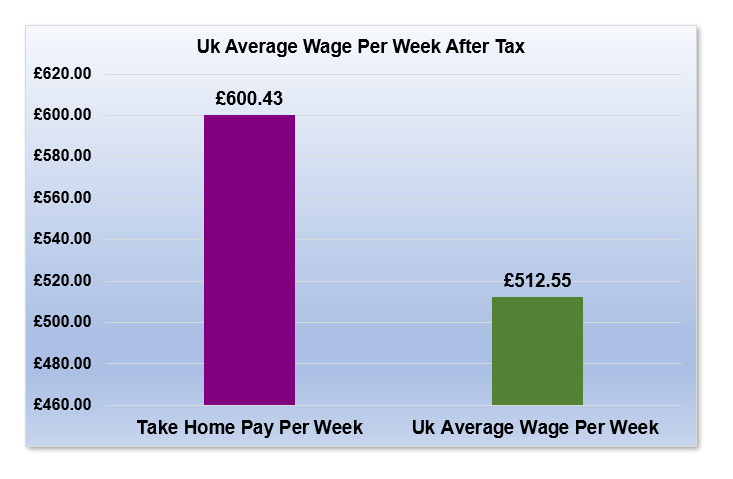

If you avoid bad debt, your dollars will stretch even further and be able to be put to work. If you earn £39,000 in a year, you will take home £30,542, leaving you with a net income of £2,545 every month. For a list of itemizable deductions, refer to Dough Roller’s ultimate list. For the breakdown of the various above-the-line deductions or adjustments, refer to this article from thebalance.com. Note that the same contributions limits apply to all ROTH and traditional IRA’s. For more information on ROTH, please read the material on the IRS website.

000.00 Tax Calculation based on 2024 Tax Tables

BTL deductions refer to the Standard Deduction or Itemized Deductions from Schedule A. A BTL deduction is always limited to the amount of the actual deduction. For example, a $1,000 deduction can only reduce net taxable income by $1,000. Examples of common BTL deductions are listed below, along with basic information. The money for these accounts comes out of your wages after income tax has already been applied. If you are early in your career or expect your income level to be higher in the future, this kind of account could save you on taxes in the long run. Also deducted from your paychecks are any pre-tax retirement contributions you make.

US Income Tax Calculator

- However, it is possible to enter these manually in the “Other” field.

- Eight states are without an income tax, and one has no wage income tax.

- Yes, it is possible to live off $39,000 a year, but your comfort depends on your location and lifestyle.

The more someone makes, the more their income will be taxed as a percentage. Generally, only taxpayers with adjusted gross incomes that exceed the exemption should worry about the AMT. The IRS provides an online AMT Assistant to help figure out whether a taxpayer may be affected by the AMT. If you’re required to pay state or local income taxes, you may face additional withholding for the appropriate taxing authorities in your state or community. Curious to know how much taxes and other deductions will reduce your paycheck?

Paycheck Calculator: Federal, State & Local Taxes

The ROTH and IRA Retirement saving calculator (Pension Contributions Comparison Calculator) allows you to compare how your money will work for you when using either of the pension schemes. You may also like to try our Traditional IRA calculator and / or the standalone ROTH IRA Calculator. 1 A negative figure indicates that you have overpaid tax and that you are due a tax rebate.

In our calculators, you can add deductions under “Benefits and Deductions” and select if it’s a fixed amount, a percentage of the gross-pay, or a percentage of the net pay. For hourly calculators, you can also select a fixed amount per hour. For pre-tax deductions, check the Exempt checkboxes, meaning the deduction will be taxed.

If you elect to contribute to a Health Savings Account (HSA) or Flexible Spending Account (FSA) to help with medical expenses, those contributions are deducted from your paychecks too. FICA contributions are shared between the employee and the employer. 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2023 is $160,200 ($168,600 for 2024). So any income you earn above that cap doesn’t have Social Security taxes withheld from it. In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes.

Enter your salary below to check tax deductions and calculate your monthly take home income. This income is not your Adjusted Gross Income (AGI) but rather your gross income adjusted for specific pre-tax deductions relevant to FICA taxes. The standard deduction is a flat 8 smart ways to use your income tax refund reduction in your adjusted gross income. The amount is determined by Congress and meant to keep up with inflation. Nearly 90% of filers take it because it makes the tax-prep process quick and easy. People 65 or older are eligible for a higher standard deduction.

If you have a simple tax situation and have filled out your W-4 correctly, taxes already withheld from your paychecks might cover that bill for the year. Likewise, if you’re a freelancer or a taxpayer who must pay estimated taxes, payments you made during the year might also cover your bill. Traditionally, most employers would offer employees vacation days, paid time off, or paid leave. Nowadays, employers tend to roll everything into one concept called paid time off (PTO). In some cases, unused PTO at the end of the year can be “exchanged” for their equivalent financial value. If a company does allow the conversion of unused PTO, accumulated hours and/or days can then be exchanged for a larger paycheck.

We’ve heard your feedback and are excited to announce that all your favorite Salary and Tax calculators are now available as dedicated apps for each State. Whether you prefer browsing on your Desktop browser or desire the convenience of an app on your Desktop, we’ve got you covered. These tools are available for free and are perfect for getting a head start on your 2025 tax return.

There are a ton of places where you can live on a $39k income level and live a comfortable life. Your dollars will stretch much further if you avoid certain parts of the country like most coastal and larger metropolitan areas of the United States (San Francisco, New York City, etc). The most important factor with any salary is to budget, invest and spend within your means.

Really easy to get started, this platform is MADE for giving, unlike PayPal so we were relieved to find an alternative that was superior! Cover the Fees™ allows your church members to take care of transaction fees, resulting in savings for your church. Enter your annual digital giving below to see your effective processing rate. Remember, we do our best to make sure our systems are up to date and error free. However, all calculations provided are estimates based upon information you provide.